Domains of Financial Literacy Among Women in Public Sector: A Systematic Literature Review

DOI:

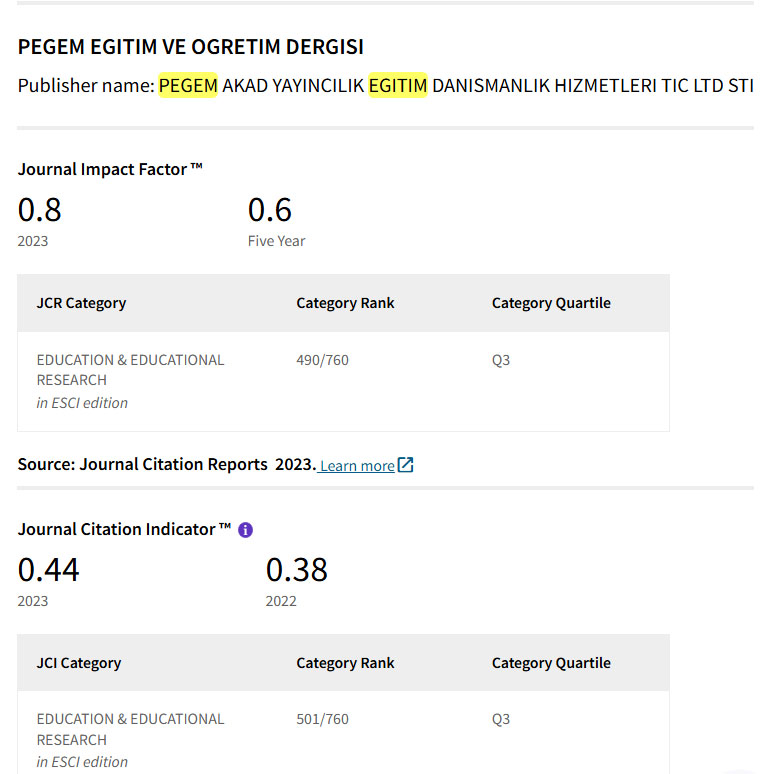

https://doi.org/10.47750/pegegog.15.02.11Keywords:

Financial Literacy, Financial Knowledge, Financial Planning, Financial Attitude, Systematic Literature Review, WomenAbstract

The objective of this study is to explore the domains that contributed to the women’s financial literacy practice with the aim of seeing the existing gaps in the literature and how financial literacy affects various elements of women’s lives. This paper adopts a systematic literature review process to collect all relevant studies, carefully examine and analyse each study separately, and finally reach a comprehensive set of conclusions and establish the domains that contributed to the financial literacy practice among women. A systematic literature review has been undertaken, comprising of academic articles collected from Scopus, Web of Science, and Google Scholar in accordance with the Reporting Standards for Systematic Evidence Syntheses (ROSES). The results obtained revealed four key domains, namely Financial Knowledge (FK), Financial Skill (FS), Financial Attitude (FA) and Financial Behavior (FB) alongside a total of 10 sub-themes. The discussion section contextualises the study's findings on financial literacy among women, putting light on implications uncovered through a rigorous literature review. The practical and theoretical implications of this research are discussed, providing insights into how the results can be applied or influence practices of financial literacy among women. These implications could encompass the woman ability to master the financial knowledge while also practicing it in the real world. This study contributes to extending the literature through thorough explanation towards the domains that contributed to the financial literacy practice among women, which may explain their relatively lagging position in this field.

Downloads

References

Arini, F. D. (2018). Financial Literacy in Women Empowerment. Advances in Social Science, Education and Humanities Research, 191, 636-644.

Arjun, T. P., & Subramanian, R. (2024). Defining and measuring financial literacy in the Indian context: a systematic literature review. Managerial Finance.

Ashaari, N. N. B., & Yusof, Z. B. M. (2019). Relationship between Financial Literacy and Its Component: A Research on Working Women. Asian Journal of Probability and Statistics, 1-6.

Ashaari, N. N., Md Yusof, Z., Misiran, M., & Sapiri, H. (2020). Financial literacy among working women: A Study on university staff in Kedah. Journal of Science and Mathematics Letters, 8(2), 100-108.

Baluja, G. (2016). Financial Literacy Among Women in India: A Review. Pacific Business Review International, 9(4), 82-88.

Bhargava, M., Sharma, A., Mohanty, B., & Lahiri, M. M. (2022). Moderating Role of Personality in Relationship to Financial Attitude, Financial Behaviour, Financial Knowledge and Financial Capability. International Journal of Sustainable Development and Planning, 17(6), 1997-2006.

Caronge, E., Mediaty, M., Fattah, H., & Khaeril, K. (2020). Effects of Financial Attitudes, Financial Behavior, and Financial Literacy to Financial Satisfaction in Women Workers (Case Study of Female Lecturer at Andi Djemma Palopo University). Proceedings of the 4th International Conference on Accounting, Management, and Economics, ICAME 2019, Makassar, Indonesia.

Dewanty, N., & Isbanah, Y. (2018). Determinant of The Financial Literacy: Case Study on Career Woman in Indonesia. ETIKONOMI, 17(2), 285-296.

Dewi, V., Febrian, E., Effendi, N., & Anwar, M. (2020). Financial Literacy among the Millennial Generation: Relationships between Knowledge, Skills, Attitude, and Behavior. Australasian Accounting, Business and Finance Journal, 14(4), 24-37.

Fazal, A., Khan, H. H., Sarwar, B., Ahmed, W., Muhammad, N., & Nabeel Ul Haq, S. M. (2021). Influence of Cognitive Ability, Money Management Skills, and Cultural Norms on the Financial Literacy of Women Working in the Cottage Industry. Asian Journal of Business and Accounting, 14(2), 255-278.

Gautam, C., Wadhwa, R., & Raman, T. V. (2022). Examining Behavioural Aspects of Financial Decision Making: The Working Women Perspective. Finance Theory and Practice, 26(6), 288-301.

Gonçalves, V. N., Ponchio, M. C., & Basílio, R. G. (2021). Women’s financial well-being: A systematic literature review and directions for future research. International Journal of Consumer Studies, 45(4), 824-843.

Haddaway, N. R., Macura, B., Whaley, P., & S. Pullin, A. (2018). ROSES Reporting standards for Systematic Evidence Syntheses: pro forma, flow-diagram and descriptive summary of the plan and conduct of environmental systematic reviews and systematic maps. Environmental Evidence, 7(7), 1-8.

Harinakshi., & Goveas, C. (2023). A Systematic Literature Review and Research Agenda of Financial Literacy, Investment Behavior and Risk Tolerance of Indian Women Investors. International Journal of Case Studies in Business, IT, and Education, 7(4), 332-352.

Hayeemaming, M. (2022). Financial Literacy of Working Women (Case Study in Malaysia). Proceedings of the International Seminar on Business, Education and Science, 1(1), 316- 322.

Iram, T., Bilal, A. R., & Latif, S. (2021). Is Awareness That Powerful? Women’s Financial Literacy Support to Prospects Behaviour in Prudent Decision-making. Global Business Review, 0(0).

Mengist, W., Soromessa, T., & Legese, G. (2020). Method for conducting systematic literature review and meta-analysis for environmental science research. MethodsX, 7(2): 100777.

Mongeon, P., & Paul-Hus, A. (2016). The journal coverage of Web of Science and Scopus: a comparative analysis. Scientometrics, 106(1), 213-228.

Muat, S., Mahdzan, N. S., & Sukor, M. E. A. (2024). What shapes the financial capabilities of young adults in the US and Asia-Pacific region? A systematic literature review. Humanities and Social Sciences Communications, 11(83).

Njaramba, J., Chigeza, P., & Whitehouse, H. (2015). Financial literacy: the case of migrant African-Australian women entrepreneurs in the Cairns region. Journal of Entrepreneurship and Sustainability Issues, 3(2), 198-208.

OECD. (2020). OECD/INFE 2020 International Survey of Adult Financial Literacy. Paris: OECD Publishing. Retrieved from: www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyrepo rt.htm

Philippas, N. D., & Avdoulas, C. (2020). Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. The European Journal of Finance, 26(4-5), 360-381.

Preston, A., Qiu, L., & Wright, R. E. (2023). Understanding the gender gap in financial literacy: the role of culture. Journal of Consumer Affairs, 1-31.

Putri, P. T., & Simanjuntak, M. (2020). The Role of Motivation, Locus of Control and Financial Literacy on Women Investment Decisions Across Generations. Journal of Consumer Sciences, 5(2), 102-123.

Rai, K., Dua, S., & Yadav, M. (2019). Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling Approach. FIIB Business Review, 8(1), 51-60.

Roy, P., & Patro, B. (2022). Financial Inclusion of Women and Gender Gap in Access to Finance: A Systematic Literature Review. Vision, 26(3), 282-299.

S, Y., Vignesh, J. S., & Kulkarni, K. (2019). A Study on Financial Literacy and Savings Pattern of Women in Bangalore City. Journal of Emerging Technologies and Innovative Research (JETIR), 6(3), 700-711.

Saputra, M. R., & Herlina, N. (2021). Relationship Between Socioeconomic Status, Literature Review Study. Journal of Borneo student research, 2(3), 1772-1780.

Sconti, A. (2022). Having Trouble Making Ends Meet? Financial Literacy Makes the Difference. Italian Economic Journal, 10(3), 1-32.

Shaffril, H. A. M., Ahmad, N., Samsuddin, S. F., Samah, A. A., & Hamdan, M. E. (2020). Systematic Literature Review on Adaptation towards Climate Change Impacts among Indigenous People in the Asia Pacific Regions. Journal of Cleaner Production, 258.

Singh, C., & Kumar, R. (2017). Study of Women’s Financial Literacy- A Case of BHU. Pacific Business Review International, 10(4), 128-136.

Sinha, M., & Gupta, M. (2016). An Empirical Study on Assessing Financial Literacy Level Among Women in Delhi NCR. International Research Journal of Commerce Arts and Science, 12(8), 126-131.

Sundarasen, S., Rajagopalan, U., Kanapathy, M., & Kamaludin, K. (2023). Women’s financial literacy: A bibliometric study on current research and future directions. Heliyon, 9(12).

V. R., S., & Naidu, J. G. (2018). Knowledge, Behaviour and Attitude: Financial Decisions and Working Women. Journal of Emerging Technologies and Innovative Research, 5(2).

Vu-Ngoc, H., Elawady, S. S., Mehyar, G. M., Abdelhamid, A. H., Mattar, O. M., Halhouli, O., Vuong, N. L., Ali, C. D. M., Hassan, U. H., Kien, N. D., Hirayama, K., & Huy, N. T. (2018). Quality of flow diagram in systematic review and/or meta-analysis. PLoS ONE, 13(6).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Pegem Journal of Education and Instruction

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

NonCommercial — You may not use the material for commercial purposes.

No additional restrictions — You may not apply legal terms or technological measures that legally restrict others from doing anything the license permits.